“LONDON, July 12, 2016 /PRNewswire/ — While the advent of autonomous driving threatens to negatively impact the automotive insurance market, it can innovate. Autonomous technologies present opportunities for new insurance services, particularly in relation to Usage Based Insurance (UBI), says ABI Research. A number of vendors already partnered with OEMs to enable UBI as an embedded service, for example Progressive (GM), State Farm (Ford) and Allianz (BMW). ADAS sensors represent the key to a more comprehensive form of UBI.

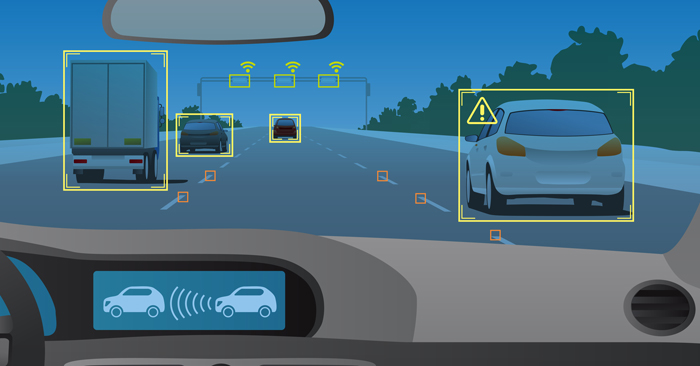

“Obstacle detection and collision avoidance will be the defining characteristics of autonomous technology across the entire spectrum of vehicle autonomy, stretching from today’s ADAS through to the driverless cars of the future,” says James Hodgson, Industry Analyst at ABI Research. “Therefore, the cars on our roads are only going to get increasingly better at preventing accidents and reducing insurance claims.”

Recent reports suggest that automatic emergency braking (AEB) has the potential to reduce front-to-rear collisions by about 40%, with vehicles fitted with AEB affording their users a discount of around 10%. And the European New Car Assessment Programme (Euro NCAP) is formulating new testing procedures to help develop lateral ADAS, which is more effective than the current technology. Given that automotive insurance accounted for 42% of the entire general insurance industry in 2015, this trend is not…”

To read the full article CLICK HERE.

Image Source